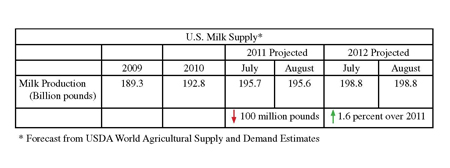

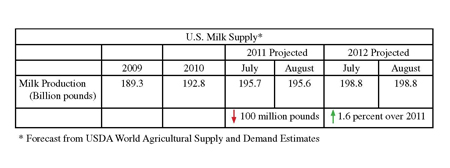

Despite the July Cattle report's indication that producers have a strong dairy replacement heifer population to back the U.S. milking herd, the milk production forecast for 2011 has been reduced by 100 million pounds. While strong heifer numbers support an expanding dairy herd, recent hot weather and elevated feed prices may hinder any escalation in milk per cow.

Commodity prices rise

Cheese, butter, and whey are forecast higher for 2011, while nonfat dry milk forecasts are down. Tighter milk supplies support this upswing in commodity pricing, while softening international prices are hindering nonfat dry milk markets.

Higher cheese and whey prices are behind the rise in Class III price. Lower nonfat dry milk prices outweigh higher butter prices, causing the reduction in Class IV.

Next year, nonfat dry milk is forecast lower due to expected weak early-year demand. Cheese prices, on the other hand, are expected to rise marginally. Butter and whey forecasts remain unchanged. Class III is expected to rise, while Class IV will decline for the same reasons it is reduced this year.

The all milk price is raised for 2011 to $20.30 to $20.50 per hundredweight. In 2012, prices may decline to $17.80 to $18.80 per hundredweight.

The USDA's World Agricultural Supply and Demand Estimates contained reports and forecast for a variety of ag sectors.

Commodity prices rise

Cheese, butter, and whey are forecast higher for 2011, while nonfat dry milk forecasts are down. Tighter milk supplies support this upswing in commodity pricing, while softening international prices are hindering nonfat dry milk markets.

Higher cheese and whey prices are behind the rise in Class III price. Lower nonfat dry milk prices outweigh higher butter prices, causing the reduction in Class IV.

Next year, nonfat dry milk is forecast lower due to expected weak early-year demand. Cheese prices, on the other hand, are expected to rise marginally. Butter and whey forecasts remain unchanged. Class III is expected to rise, while Class IV will decline for the same reasons it is reduced this year.

The all milk price is raised for 2011 to $20.30 to $20.50 per hundredweight. In 2012, prices may decline to $17.80 to $18.80 per hundredweight.

The USDA's World Agricultural Supply and Demand Estimates contained reports and forecast for a variety of ag sectors.