Last year was a banner year for U.S. dairy product exports, which accounted for a record 13.3 percent of all milk production in the country on a total solids basis. That's roughly 26 billion pounds of milk and $4.8 billion of product value that we didn't have to sell at home - a feat that would have been impossible to accomplish. It's an achievement that also played a huge role in Class III prices setting a new record average of $18.37 for the year.

This year, drought-driven feed prices that are still rising, lower total output that may result from it, milk prices that have already turned sharply higher and the negative impact they may have on foreign demand, are big unknowns for the rest of 2012. Even so, it's encouraging to remember that dairy exports got off to a strong start in the first half.

Data released in August by the producer-funded U.S. Dairy Export Council (USDEC) show that total dairy product exports during the first six months of 2012 amounted to 13.6 percent of total solids production and $2.74 billion in sales. A lot could change during the next six months, but exporters are definitely on another record pace.

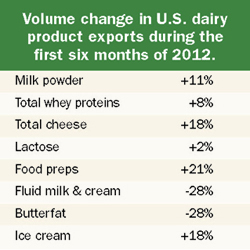

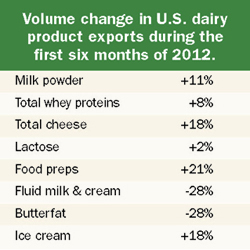

What is the world buying more of from the U.S. this year? With the exception of two small volume products, almost everything.

Dry milk powders and whey proteins continued to dominate U.S. export volumes to a degree that may surprise some producers. For example, 66 percent of all dried lactose produced in the U.S. during the first half of 2012 was exported, as was 49 percent of all dry sweet whey and 45 percent of all nonfat dry milk and skim milk powder.

In terms of popularity growth, cheese continues to dazzle as the world's taste for it spreads. U.S. manufacturers exported 140,738 metric tons during the first half of 2012 - more than the full-year totals in 2005 and 2006 combined.

This year, drought-driven feed prices that are still rising, lower total output that may result from it, milk prices that have already turned sharply higher and the negative impact they may have on foreign demand, are big unknowns for the rest of 2012. Even so, it's encouraging to remember that dairy exports got off to a strong start in the first half.

Data released in August by the producer-funded U.S. Dairy Export Council (USDEC) show that total dairy product exports during the first six months of 2012 amounted to 13.6 percent of total solids production and $2.74 billion in sales. A lot could change during the next six months, but exporters are definitely on another record pace.

What is the world buying more of from the U.S. this year? With the exception of two small volume products, almost everything.

Dry milk powders and whey proteins continued to dominate U.S. export volumes to a degree that may surprise some producers. For example, 66 percent of all dried lactose produced in the U.S. during the first half of 2012 was exported, as was 49 percent of all dry sweet whey and 45 percent of all nonfat dry milk and skim milk powder.

In terms of popularity growth, cheese continues to dazzle as the world's taste for it spreads. U.S. manufacturers exported 140,738 metric tons during the first half of 2012 - more than the full-year totals in 2005 and 2006 combined.