The October Penn State Dairy Outlook is available!

by Jim Dunn, Professor of Agricultural Economics, Penn State University Market Psychology

The CME block cheese price fell by 1.5% in the last month, ending 2¢/lb. lower at $1.78/lb. The price rose in mid-September, but quickly slipped lower, hitting $1.75/lb. before rebounding a few cents. Butter rose in the first half of September, but flattened out since, ending the period at $1.61/lb., up 17¢, or 11.8% since last month. Butter inventories are high, yet the price is up as well. Butter exports have been high, and presumably will continue to be high, given the weaker dollar (see below) and the prices relative to New Zealand prices. Skim milk powder continues to creep up, rising another 2.6¢/lb. in gradual steps. Dry whey prices are down 0.13¢ at $0.539/lb., continuing a long period of stability.

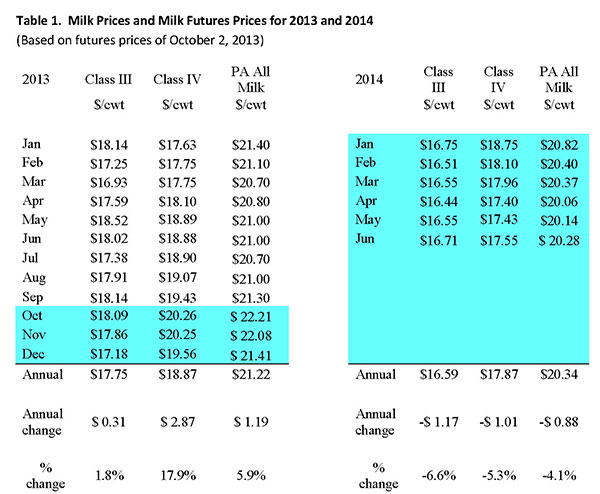

Table 1 lists some past and estimated future milk prices. The September Pennsylvania all-milk price was $0.30 higher than August at $21.30/cwt. The September Class III price was $0.23 higher than in August at $18.14/cwt. The Class III futures price for October is $18.09. Class III futures prices for the rest of 2013 are up a bit from last month, averaging $17.71/cwt. for the remainder of 2013. The Class III futures for the first half of 2014 are below $17.00, averaging $16.59. The sharp increase in August milk production (see below) and lower feed prices are expected to trigger increased production. I would have expected that the events of the past few weeks would have hurt futures prices more than they have. The September Class IV price was up $0.36/cwt. from August at $19.43/cwt. The Class IV futures price for October is $20.26 and the prices of Class IV futures average $20.02/cwt. for the rest of 2013. This is up about 50¢/cwt. over a month ago, as the strong butter market has buoyed Class IV prices. Based on the futures prices, the forecast PA all-milk prices for 2013 and the first six months of 2014 are also shown in Table 1.

The U.S. dollar is down in the past month against the Euro and the Australian and the New Zealand dollars. The latest Global Dairy Trade Auction had the prices of all of the common dairy commodities that the U.S. exports higher than two weeks earlier, so the current market is positive for milk prices in that regard.

Corn and Soybean Markets

Corn, soybeans, and soybean meal all have fallen recently. The latest stocks report showed a surprisingly high level of corn and soybean stocks, knocking about 12¢/bu. off of the December corn contract and 50¢/bu. off of November soybeans. December futures are $4.39/bu. and November beans at $12.74/bu., so corn has lost $0.38/bu. since last month and beans have lost $1.30/bu. The harvest is progressing pretty well for both crops. The government shutdown will affect the many Department of Agriculture reports that the industry follows, and will make decision making more challenging in the absence of this impartial data. The dairy analysts have been missing the milking herd reports during the budget sequestration, but that is nothing compared to no reports whatsoever. A major advantage of government reporting is that it evens the playing field for interpreting market conditions, offsetting partially the information advantage the major players have.

Income over Feed Costs (IOFC)

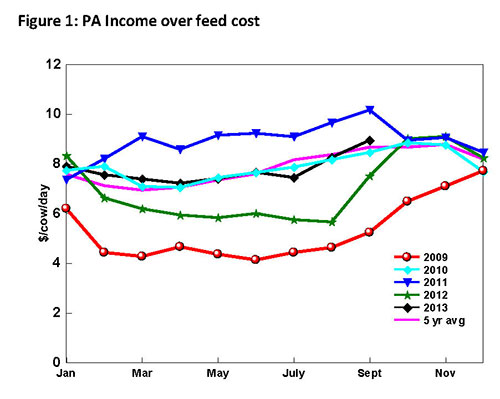

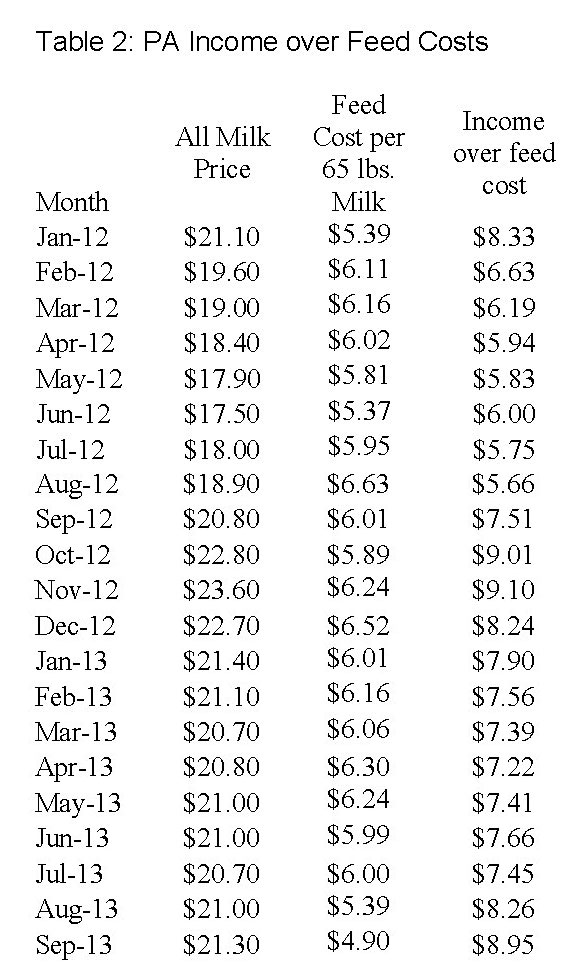

Penn State's measure of income over feed costs rose by 8.3% in September. This is an increase of 69¢/cow/day. The September value is $8.95/cow/day, which is the highest value in 2013, and the highest since November 2012. As seen in Figure 1, the IOFC level for September 2013 is the best September value other than 2011 in the past four years. The increases in September resemble those of August and are the result of essentially the same factors. Most of the increase in IOFC is because of a lower feed cost prices, which fell by 9.2% from August levels. Pennsylvania corn prices are down sharply from $6.10 to $5.00 per bushel and hay prices fell 5.8%. The soybean meal price rose, reflecting the dry conditions in the western Corn Belt in August and September. The September PA all-milk price rose by $0.30 from August to $21.30/cwt. The cost of feeding a cow fell by 49¢/day to $4.90. Income over feed cost reflects daily gross milk income less feed costs for an average cow producing 65 pounds of milk per day. Figure 1 and Table 2 showing the monthly data are appended.

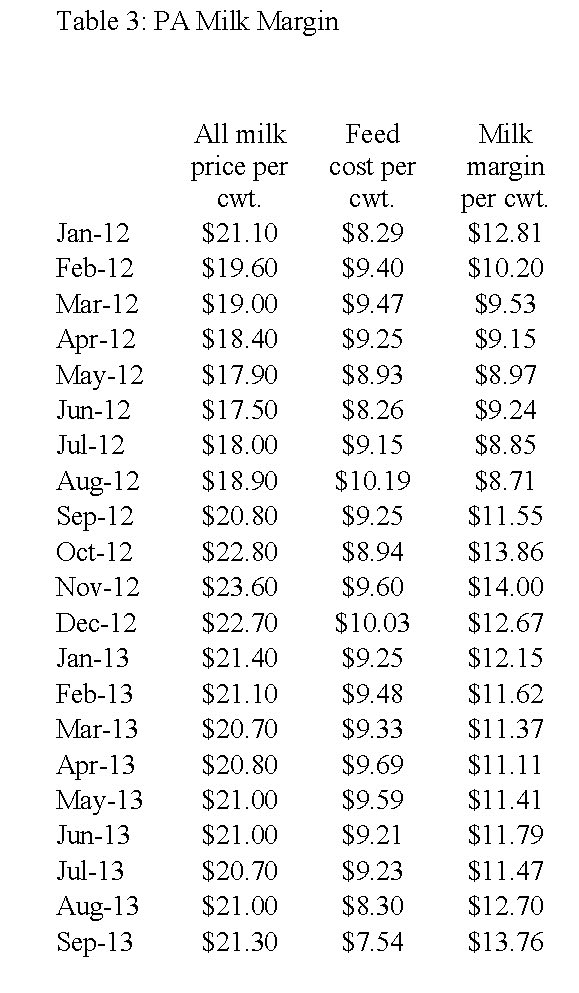

The allocation of the revenue per hundred pounds of milk is shown in Table 3. The milk margin is the estimated amount from the Pennsylvania all milk price that remains after feed costs are paid. As does income over feed cost, this measure shows that the September PA milk margin was 8.3% higher than August.

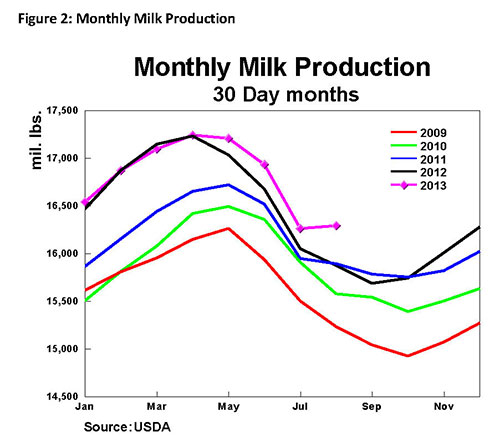

Milk Production

As can be seen in Figure 2, milk production for August was 2.6% more than the previous year. In addition August milk production was higher than in July, for the only time in the data I have starting in 1930. Certainly, the higher production compared to a year ago is not a good sign for milk prices, although the market response has not reflected that. The lower feed prices will benefit those producers that buy most their feed, so a further growth in milk production is certainly likely. So far the export levels are supporting the prices. Some improved producing conditions in the Southern Hemisphere may undermine exports, although so far exports are strong. The milk production report continues to lack cow numbers and milk per cow because of the Federal budget sequester, so until it returns to normal in two months, interpreting the report involves a certain about of guessing about to what degree any changes are from cow numbers or milk per cow. This of course assumes the government shutdown ends before that.

Dairy Outlook October 13 in pdf format.

10.03.2013