By Jim Dunn

Professor of Agricultural Economics,

Penn State University

Market Psychology

The value of the dollar rose against the currencies of other dairy exporters, although less than in recent months. Greece has worked out a deal with the European Union, although its troubles are far from over. China continues to not buy dairy products and the Russian embargo will continue for another year. Despite lower prices, producers in Europe, New Zealand, and Australia are not cutting back on production so far. The corn and soybean crops have struggled with a satellite report that the 2015 crop is worse than expected. The prices of the exportable powdered dairy products have fallen sharply in the past month, with skim milk powder down by 15.8%, and dry whey by 16.7%. These products have been closely tied to export markets and fallen with world markets, while cheese and butter have risen slightly, by 3.7% and 2.3% respectively.

The Australian dollar is down 1.1% and the New Zealand dollar down by 1.0%., while the Euro has fallen by 0.2%. These lower currency values reflect weak export markets in China for Australia and New Zealand, and the loss of the Russian market for the European Union. While the general problems in the importing major importing countries adversely affect the United States, we have more of a stand-alone economy and greater dependence on the markets in Central and South America, which ae not as weak as Asia.

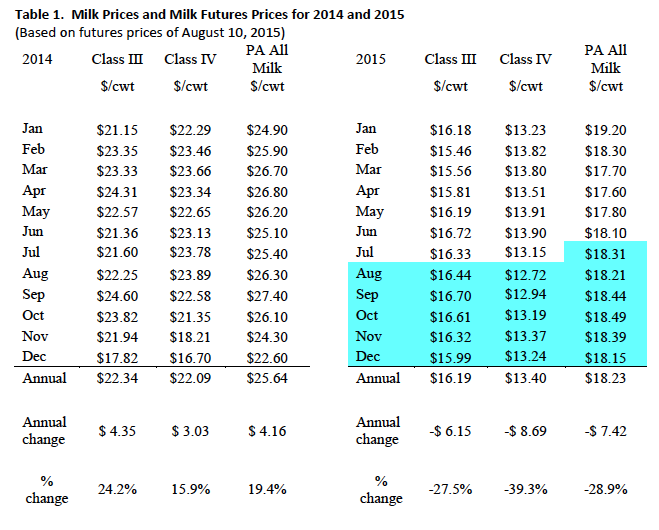

Table 1 lists some past and estimated future milk prices. I estimate the July Pennsylvania all-milk price to be $18.31/cwt, up $0.21 from June. The dairy futures market prices for Class III and IV show weak prices in the rest of 2015, especially Class IV. The average Class III price for the first seven months was $16.04/cwt. and the future prices for the last five months of 2015 average $16.41. The July Class IV price was down $0.75/cwt. from June at $13.15/cwt. The Class IV futures prices are lower than the $13.62 for January through July, averaging $13.09 for the next five months. Class IV in particular has been torpedoed by the maintenance of skim milk powder exports by matching the lower world powder prices. The result is that Class III and Class IV prices have gone their separate ways, while both were about the same price in 2014, and Class IV was $1.06 higher than Class III in 2013 My forecast for the average Pennsylvania all-milk price for 2015 is $18.23/cwt., which is $7.42/cwt. below the 2014 average.

The relatively strong U.S. dollar continues to hurt U.S. exports of dairy products. Prices in the Global Dairy Trade auctions in New Zealand continue to fall. Although El Niño generally means drought in New Zealand and Australia, this year it has not disrupted dairy production to a meaningful degree.

Corn and Soybean Markets

Corn and soybean markets have stabilized, as the weather in the western Corn Belt has offset some of the potential ill effects of the wet conditions in the eastern Corn Belt. The cool summer is helping dairy farmers in the Great Lakes states, although hay harvest has been a problem.

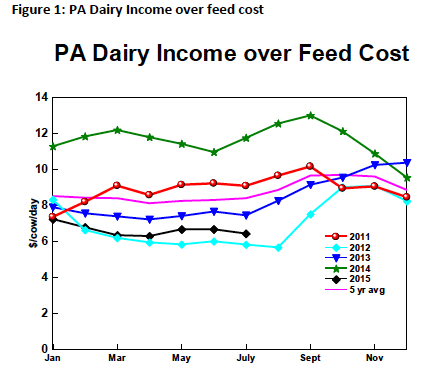

Income over Feed Costs (IOFC)

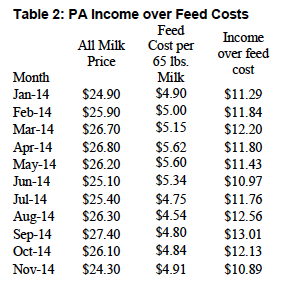

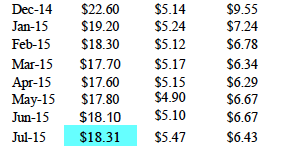

Penn State's measure of income over feed costs fell by 3.5% in July, as milk prices rose but feed prices rose by more. Figure 1 shows how these values compare to recent years. July's feed cost is 37¢/cow/day more than in June. July's value for IOFC of $6.43/cow/day is far below the 2014 value, when the milk price was very high and feed prices were somewhat lower. The higher feed prices caused the lower IOFC in July. Income over feed cost reflects daily gross milk income less feed costs for an average cow producing 65 pounds of milk per day. Table 2 and Figure 1 showing the monthly data follow.

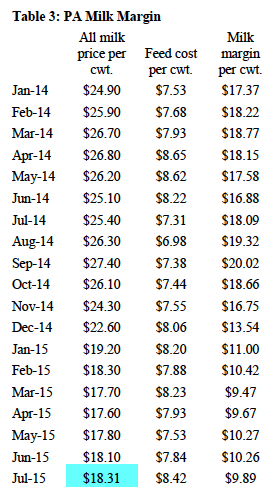

The allocation of the revenue per hundred pounds of milk (milk margin) is shown in Table 3. The milk margin is the estimated amount of the Pennsylvania all milk price that remains after feed costs per hundredweight of milk production are paid. Like income over feed cost, this measure shows that the June PA milk margin was 3.6% lower than in June. Given the margin situation and prospects for the near future, this may be the year to enroll in the Dairy Margin Protection Program offered by USDA. The enrollment period for Year 2 of the Program ends September 30, 2015.

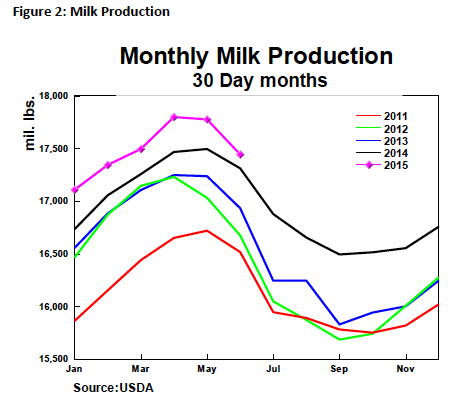

Milk Production

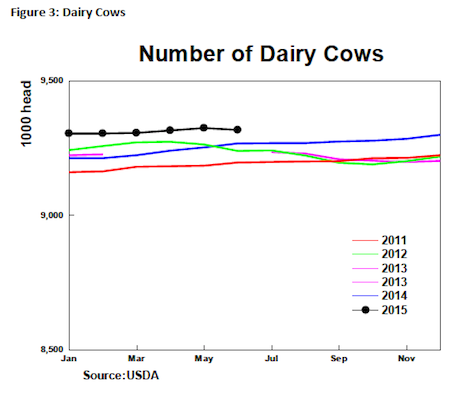

The latest milk production report showed June milk production up 0.8% from a year earlier, but down from last month (Figure 2). This increase in milk production is below the percentage increase of last June, and more importantly it is a decrease from May's milk production. It is especially important, in that on a 30 day month basis, milk production in June was below May, which is a logical response to the impact of the California drought and the low milk prices and margins. The monthly cow numbers are shown in Figure 3. The June cow numbers rose by only 0.54%. This growth is minimal, although some states have been increasing herd size, especially Michigan, Minnesota, and Iowa. Year over year cow number increases continue to be a source of milk production growth, despite the falling milk production in California (-4.3%). The growth in cow numbers last year was much greater than this year. Of course, the incentives were much greater as well.

8.19.2015