The article on page 536 of the August 25, 2011 issue discusses costs of raising replacement heifers. It describes both the cash and accrual methods of accounting for heifer values. The figure here is an example of accrual accounting.

Generally Accepted Accounting Principles (GAAP) are rules that all accountants in the U.S. are required to follow when preparing accrual- based financial statements. For dairy purposes, when a cow is put into productive use, the cost is depreciated over the animal's useful life which usually is five to seven years. It is referred to as depreciation of dairy cow's expense. Once the cow is removed from the herd (sold or died), the remaining cost that has not been depreciated is removed and compared to the cull cow proceeds.

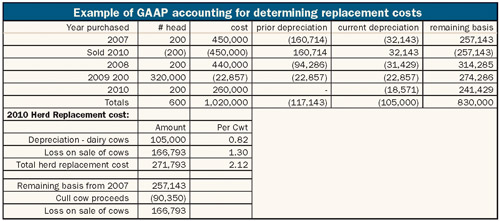

The figure is a simple example of tracking depreciation and calculating replacement costs using the GAAP method. Using an example herd with simple metrics, there is a depreciation schedule for cows and a replacement cost calculation. Assume the dairy was started in 2007 and has a 33 percent historical cull rate. In 2010, the dairy sold 128,772 hundredweights and received $90,350 in cull cow proceeds.

In the example, heifer prices reflect historic trends: $2,250 per head in 2007, $2,200 per head in 2008, $1,600 per head in 2009, and $1,300 per head in 2010. Note that, since cull rate is 33 percent, only three years of cows are on the depreciation schedule at the end of each year.

Let's use 2007 as an example year to explain the calculations in the figure. You purchased 200 heifers at $2,250 for a total of $450,000. The current depreciation on those heifers in 2010 is $32,143; the depreciation in 2007 to 2009 totaled $160,174. The remaining basis at the end of 2010 is $257,143 (450,000 - $160,714 - $32,143).

The GAAP replacement cost in the figure is $2.12 per hundredweight. This is comprised of depreciation (82 cents) and loss on sale of cows ($1.30) as follows:

The depreciation is simply the sum of all 2010 depreciation. Cows purchased in 2007, 2008, 2009, and 2010 had depreciation in 2010 that totaled $105,000 or 82 cents per hundredweight.

The remaining basis at the end of 2010 ($257,763) is offset by cull cow proceeds ($90,500), for a $166,793 or $1.30 per hundredweight loss on sale of cows.

Note that the more expensive cows purchased in 2007 were removed in 2010 which resulted in a high herd replacement cost ($2.11 per hundredweight) for 2010. The cash method may be more useful when prices are fluctuating, as it more closely reflects markets and management in the year measured.