The author is the director of dairy policy analysis at the University of Wisconsin.

Bea Arthur was an American actress. Most of the characters she played, as well as her personality in real life, were by all accounts outspoken. She is attributed to have said, "I'm not playing a role. I'm being myself, whatever the hell that is."

The U.S. dairy industry has a role to play in world markets - not necessarily by choice, but rather because of the way we "grew up." With our abundant agronomic resources, it has made economic sense for most dairy farms to move away from the pasture-based system of our grandfathers toward a much more intensive style of dairying. Large field sizes could accommodate large tractors and equipment; relatively inexpensive feed could be bought or stored economically; we could breed cows for high milk yields; and try to capture economies of scale.

Economics teach us that we will maximize our profits (in a competitive market) where marginal cost equals price. Marginal costs, of course, include a return to labor and management as well as feed, utilities, veterinary care, medicine and so forth. We see this kind of behavior in the dairy markets. A high milk price and strong profit is a signal telling producers the market wants more milk. It is providing both the incentive and the wherewithal to milk a few more cows and to try and get more milk per cow by maybe raising the ration density.

Intensive dairying has shaved our costs over the years. But 20 years ago, the costs of producing 100 pounds of milk was even lower in the pasture-based systems of New Zealand than they were in the U.S. This was because the world price for dairy products was much lower than our domestic prices. The New Zealand dairy producers were making as much milk as they profitably could at their lower milk prices.

When world milk prices began to rise in the mid-1990s, U.S. producers were not affected because we did not export a significant volume of product. However, New Zealand producers experienced higher prices and stronger profits. That was their signal that the market wanted more milk. Under its pasture-based system, the only way to expand milk production was to acquire more land and cows.

New Zealand producers acquired more land by bidding it away from sheep production or developing more marginal (hilly) land. The competition among producers for land pushed values way up. From 1990 to 2009, agricultural land values in New Zealand rose sevenfold (from about $5,000 to $35,000 per hectare). We will almost always see profits put price pressure on the most binding constraint to production. When that happens, marginal costs increase to the level of the milk price.

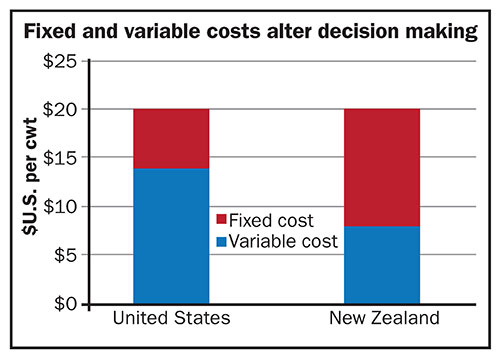

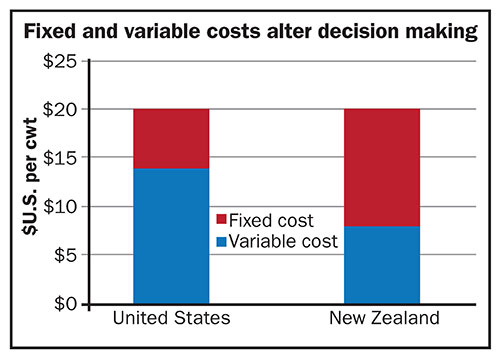

We often partition costs into "fixed" and "variable" categories. Fixed costs are the ones we are committed to, at least in the short run, while variable costs are the ones immediately associated with production. For instance, the cost of feed is a variable cost. If we were going to cull one of our cows and not produce her milk, we don't incur the cost of feeding or milking her and those costs are variable with production. However, we decided to buy the land and build the barn a few years ago, and we will continue to incur the costs to own and maintain the land and building even though the cow may be gone. Those are fixed costs.

Cost structure - the partition between fixed and variable costs - matters. Let's assume that your total cost of production is $20 per hundredweight and that $14 are your variable costs and $6 are fixed. If the milk price drops to $16, you would be losing $4 per hundredweight until the price recovers to $20 or more.

If the milk price drops to $12, you now have a decision to make. Either you keep milking with no changes in your management and you lose $8 per hundredweight, or you can stop producing milk - in which case you no longer incur those variable costs of production even though you will still have to pay for the fixed costs of $6. But you are losing less than if you were producing the milk.

In reality, the partition between fixed and variable costs is blurry. For instance, when you are losing even a dime per hundredweight there are some costs that you can choose to forego. Maybe you put off painting the barn until you have a better year. And, when profits increase a bit, you might not cull that end-of-lactation cow because the value of her milk is still more than her variable cost of production.

The U.S. intensive system of dairying has given us relatively low fixed costs and relatively high variable costs when compared with a typical New Zealand dairy farm. High land values in New Zealand have yielded relatively higher fixed costs and lower variable costs than we have. The graph illustrates an example.

If the milk price drops to $16, then farms in the U.S. and New Zealand are both losing $4 per hundredweight but neither of them have serious management choices to make. However, if the milk price falls to $12, the New Zealand producer will still continue to produce milk even at a substantial loss, but the U.S. producer will stop production and lose less in the short run.

In a world of volatile milk prices, our intensive milk production and cost structure means that we are first to respond to higher profits and, unfortunately, we are also first to reduce production when the price drops. This means that the U.S. producer faces price risk. The New Zealand producer is not happy about the loss of profitability, but he or she will not alter his or her production strategy unless the milk price falls below his variable costs. The pasture-based system is much more vulnerable to weather, and he or she will cull or add cows to produce as much milk as the pasture will support. New Zealand producers face production risk.

As long as we are involved in export markets, it is hard for the U.S. to not accept the role of balancing the world's milk supply. It isn't necessarily something we signed up for, but it is a by-product of the intensive milk production system that we have pioneered.

Click here to return to the Dairy Policy E-Sources

150825_527

Bea Arthur was an American actress. Most of the characters she played, as well as her personality in real life, were by all accounts outspoken. She is attributed to have said, "I'm not playing a role. I'm being myself, whatever the hell that is."

The U.S. dairy industry has a role to play in world markets - not necessarily by choice, but rather because of the way we "grew up." With our abundant agronomic resources, it has made economic sense for most dairy farms to move away from the pasture-based system of our grandfathers toward a much more intensive style of dairying. Large field sizes could accommodate large tractors and equipment; relatively inexpensive feed could be bought or stored economically; we could breed cows for high milk yields; and try to capture economies of scale.

Costs drive trade

Economics teach us that we will maximize our profits (in a competitive market) where marginal cost equals price. Marginal costs, of course, include a return to labor and management as well as feed, utilities, veterinary care, medicine and so forth. We see this kind of behavior in the dairy markets. A high milk price and strong profit is a signal telling producers the market wants more milk. It is providing both the incentive and the wherewithal to milk a few more cows and to try and get more milk per cow by maybe raising the ration density.

Intensive dairying has shaved our costs over the years. But 20 years ago, the costs of producing 100 pounds of milk was even lower in the pasture-based systems of New Zealand than they were in the U.S. This was because the world price for dairy products was much lower than our domestic prices. The New Zealand dairy producers were making as much milk as they profitably could at their lower milk prices.

When world milk prices began to rise in the mid-1990s, U.S. producers were not affected because we did not export a significant volume of product. However, New Zealand producers experienced higher prices and stronger profits. That was their signal that the market wanted more milk. Under its pasture-based system, the only way to expand milk production was to acquire more land and cows.

Land fueled milk production

New Zealand producers acquired more land by bidding it away from sheep production or developing more marginal (hilly) land. The competition among producers for land pushed values way up. From 1990 to 2009, agricultural land values in New Zealand rose sevenfold (from about $5,000 to $35,000 per hectare). We will almost always see profits put price pressure on the most binding constraint to production. When that happens, marginal costs increase to the level of the milk price.

We often partition costs into "fixed" and "variable" categories. Fixed costs are the ones we are committed to, at least in the short run, while variable costs are the ones immediately associated with production. For instance, the cost of feed is a variable cost. If we were going to cull one of our cows and not produce her milk, we don't incur the cost of feeding or milking her and those costs are variable with production. However, we decided to buy the land and build the barn a few years ago, and we will continue to incur the costs to own and maintain the land and building even though the cow may be gone. Those are fixed costs.

Cost structure - the partition between fixed and variable costs - matters. Let's assume that your total cost of production is $20 per hundredweight and that $14 are your variable costs and $6 are fixed. If the milk price drops to $16, you would be losing $4 per hundredweight until the price recovers to $20 or more.

If the milk price drops to $12, you now have a decision to make. Either you keep milking with no changes in your management and you lose $8 per hundredweight, or you can stop producing milk - in which case you no longer incur those variable costs of production even though you will still have to pay for the fixed costs of $6. But you are losing less than if you were producing the milk.

In reality, the partition between fixed and variable costs is blurry. For instance, when you are losing even a dime per hundredweight there are some costs that you can choose to forego. Maybe you put off painting the barn until you have a better year. And, when profits increase a bit, you might not cull that end-of-lactation cow because the value of her milk is still more than her variable cost of production.

Two different cost structures

The U.S. intensive system of dairying has given us relatively low fixed costs and relatively high variable costs when compared with a typical New Zealand dairy farm. High land values in New Zealand have yielded relatively higher fixed costs and lower variable costs than we have. The graph illustrates an example.

If the milk price drops to $16, then farms in the U.S. and New Zealand are both losing $4 per hundredweight but neither of them have serious management choices to make. However, if the milk price falls to $12, the New Zealand producer will still continue to produce milk even at a substantial loss, but the U.S. producer will stop production and lose less in the short run.

In a world of volatile milk prices, our intensive milk production and cost structure means that we are first to respond to higher profits and, unfortunately, we are also first to reduce production when the price drops. This means that the U.S. producer faces price risk. The New Zealand producer is not happy about the loss of profitability, but he or she will not alter his or her production strategy unless the milk price falls below his variable costs. The pasture-based system is much more vulnerable to weather, and he or she will cull or add cows to produce as much milk as the pasture will support. New Zealand producers face production risk.

As long as we are involved in export markets, it is hard for the U.S. to not accept the role of balancing the world's milk supply. It isn't necessarily something we signed up for, but it is a by-product of the intensive milk production system that we have pioneered.

150825_527